Do You Have to Apply Own Car Insurance Malaysia

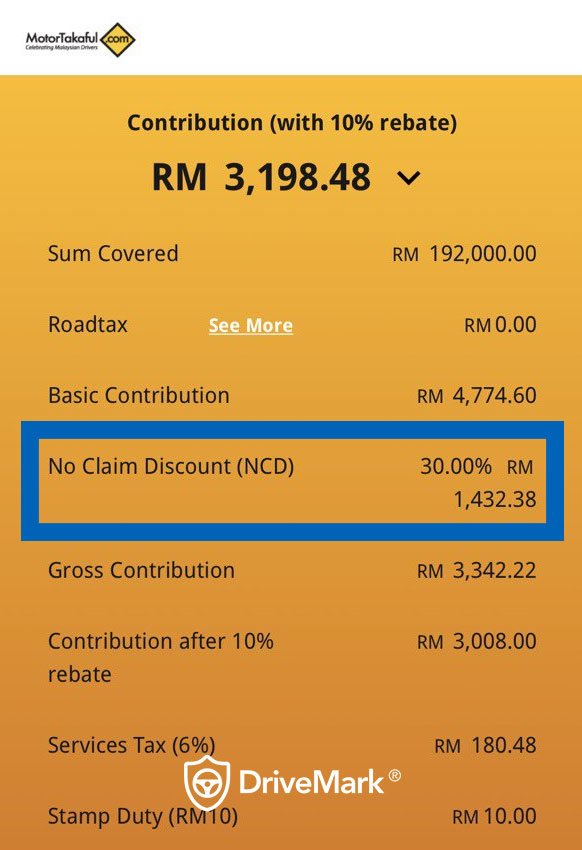

For example if you do not make any insurance claims in your first 12 months of having a car insurance plan you will receive a discount of 25 on your premium payment for the following year. If you do not own third party car insurance you will not be able to renew your vehicles road tax from Road Transport Department JPJ Malaysia.

Car Insurance Premium Calculation Ncd Rate In Malaysia

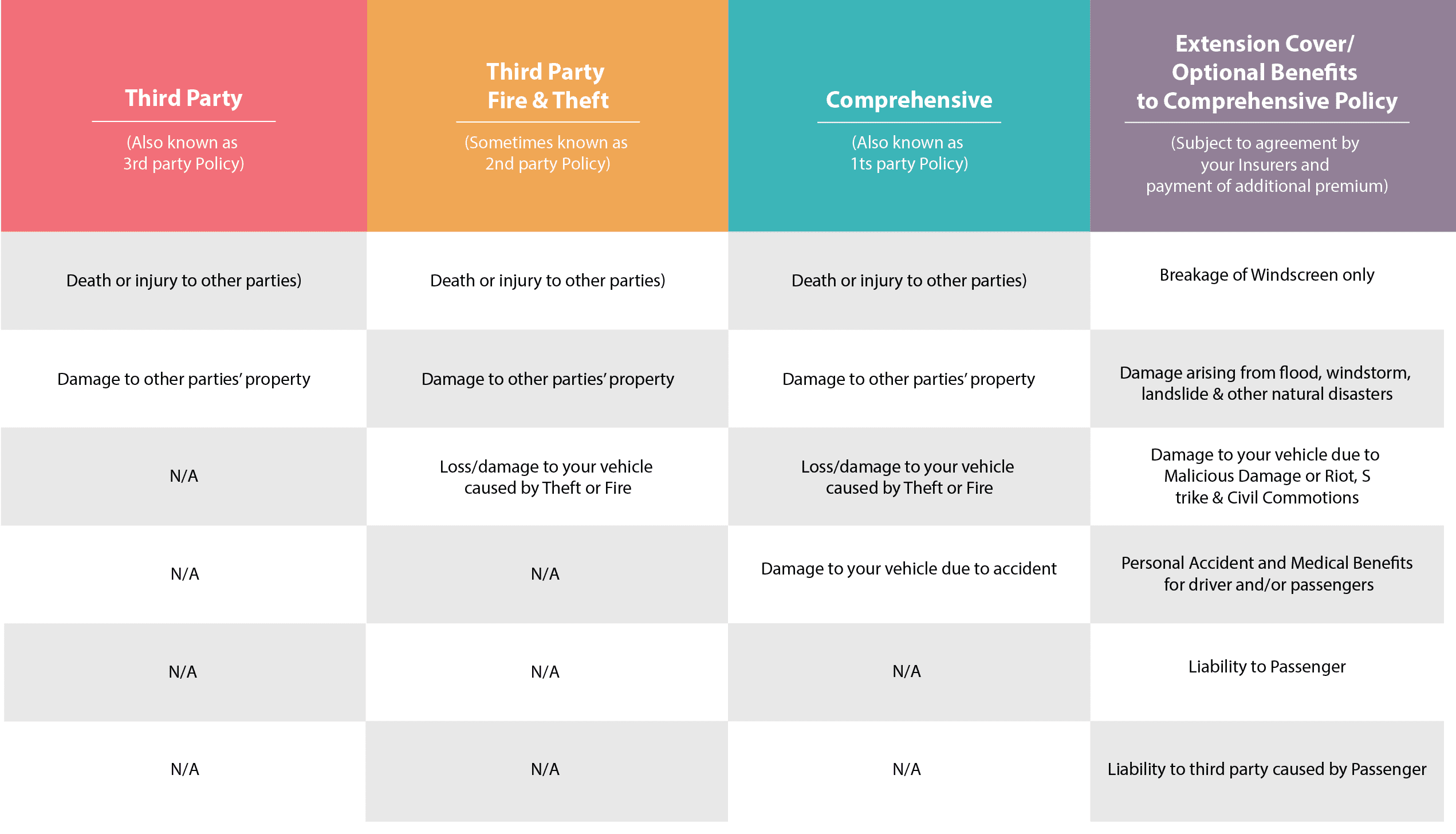

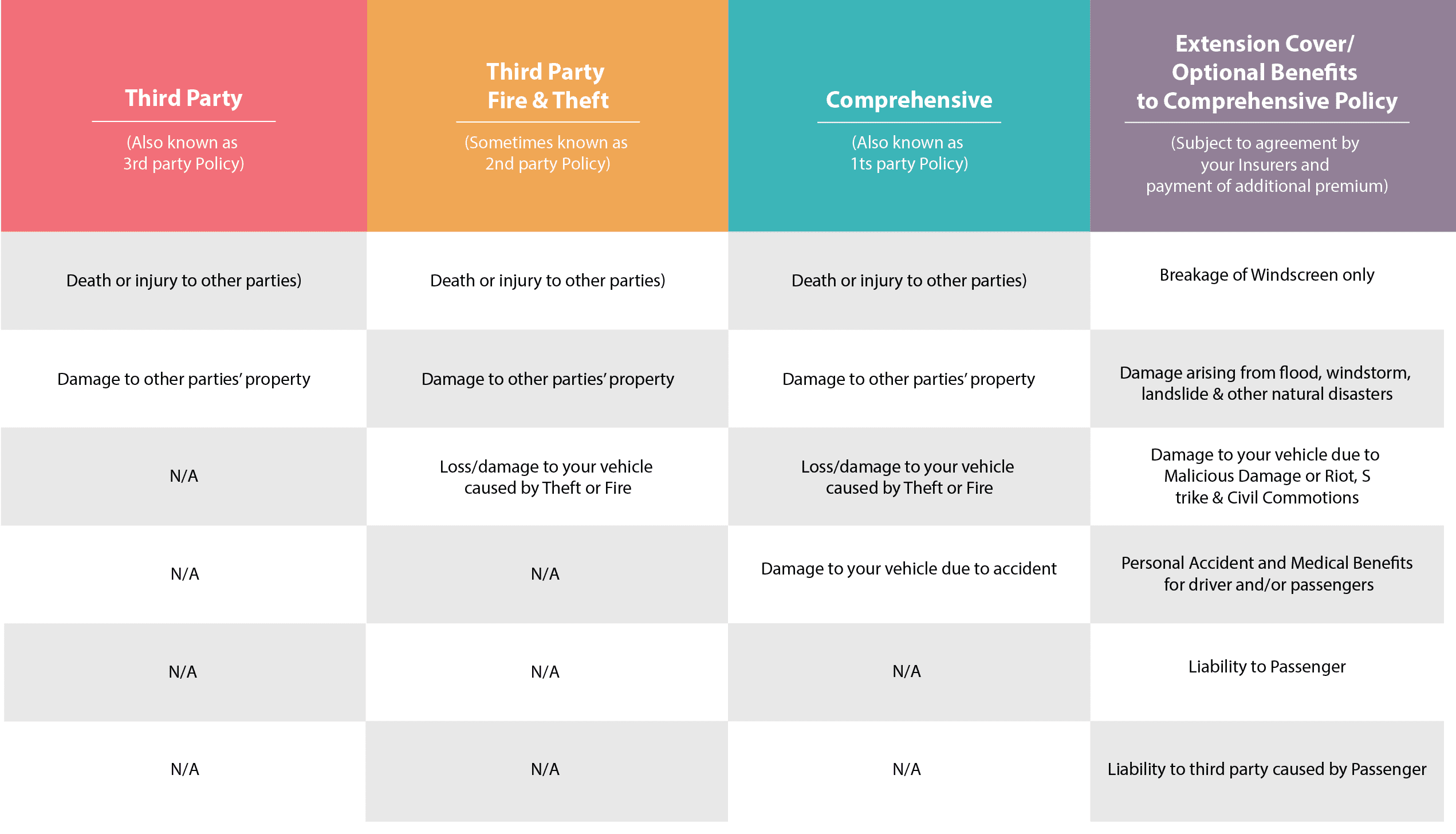

This type of insurance covers provides minimum cover as required by the law.

. Buying third party car insurance is compulsory in Malaysia if you own a car. Heres a simple step-by-step guide on how to submit your car insurance claim. In fact you need to get your car insurance sorted out before you can even pay road tax another compulsory requirement for car owners.

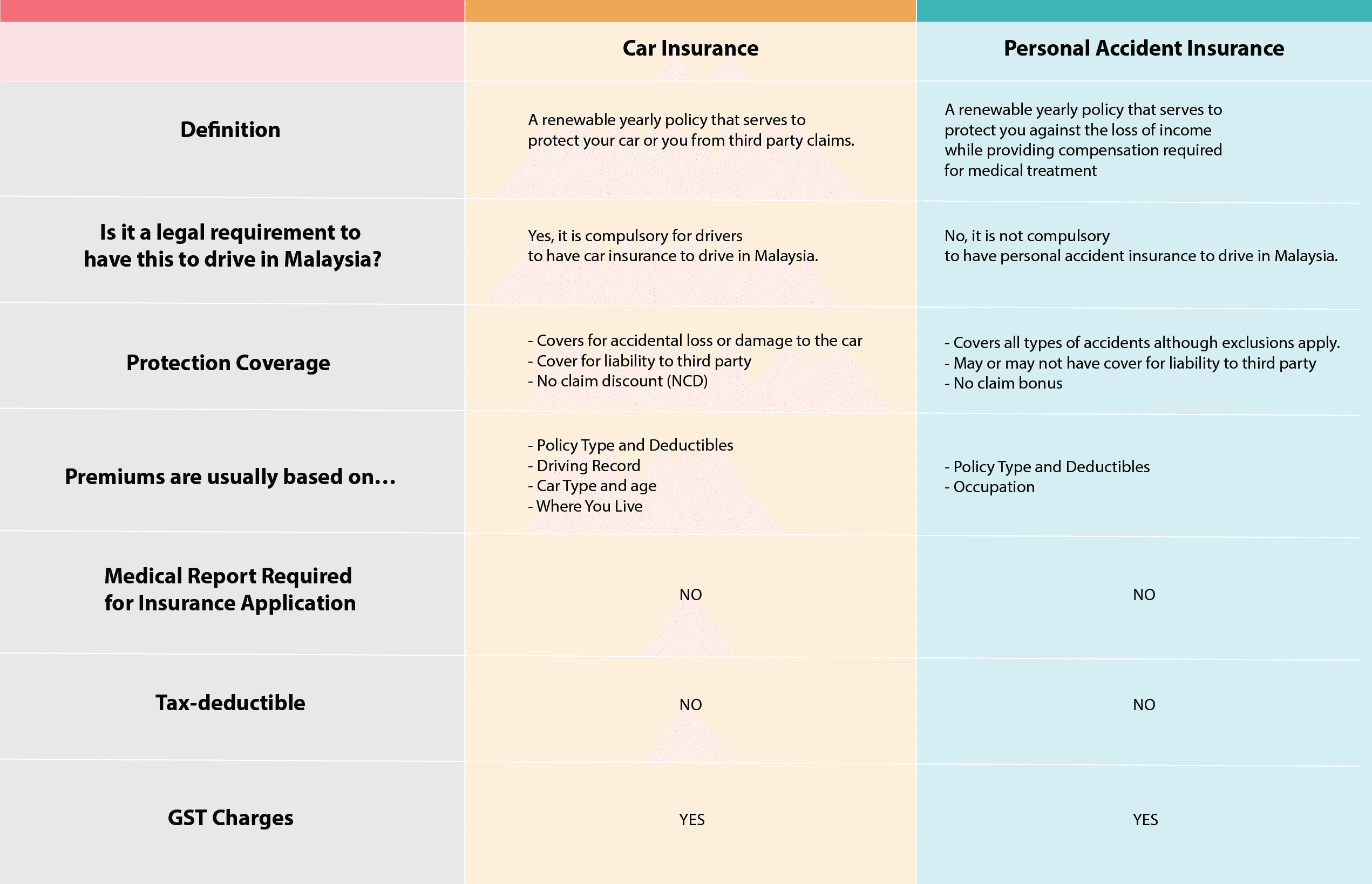

For instance if youre a solid driver with a good track record you can save money over time by not making claims from your insurer. As in many countries you are required to display your road tax sticker on the windscreen of your car which you will receive when. On the other hand personal accident insurance is not a compulsory cover.

Driving without a valid road tax can cost you penalty in fines up to RM3000 depending on courts decision. Heres a table on the NCD rates for car insurance in Malaysia. This is the most basic and common car insurance bought by car owners as it is mandatory to have this type of car insurance for every vehicle.

If you are caught driving without a road tax you are breaking the law and may be fined up to RM 3000 under Section 14 4 of the Road Transport Act RTA 1987. These insurances provide different forms of compensations to you. Third party insurance is the most basic and most commonly purchased among the three.

There are a few things that need to be kept in mind when applying for a third party car insurance online in Malaysia. Insurance protection is fairly limited to only meeting liability costs for. The three main categories of car insurance are.

Motor insurance is compulsory in Malaysia. Get the other drivers full name identity card number license plate number insurance company policy number address and phone number. You may need to exchange this information with the other party as.

Basically car insurance protects you against the losses or damages of your vehicle or the third partys vehicle due to accidents fire or theft depending on the policy selected. Market Value of the car. Apply online now via RinggitPlus.

Contact your insurance company ASAP. If you want to use your own preferred company you may have to put some pressure on them to change. Let them know about what has just happened and youll be guided on your immediate next steps.

According to the Road Transport Act of 1987 all vehicle owners are required to have car insurance in Malaysia and road tax in order to legally drive on the road. Car owners probably know this but its worth mentioning as stated in the Road Transport Act 1987 car insurance is compulsory. According to the Road Transport Act 1987 it is compulsory for all car owners in Malaysia to have a valid car insurance and road tax both of which need to be renewed on a yearly basis.

Car insurance covers beyond Singapore up to West Malaysia and South Thailand within 80km of its border from West Malaysia. Aside from that legal requirement you also need car. True to its name it provides coverage for the third party involved in any car.

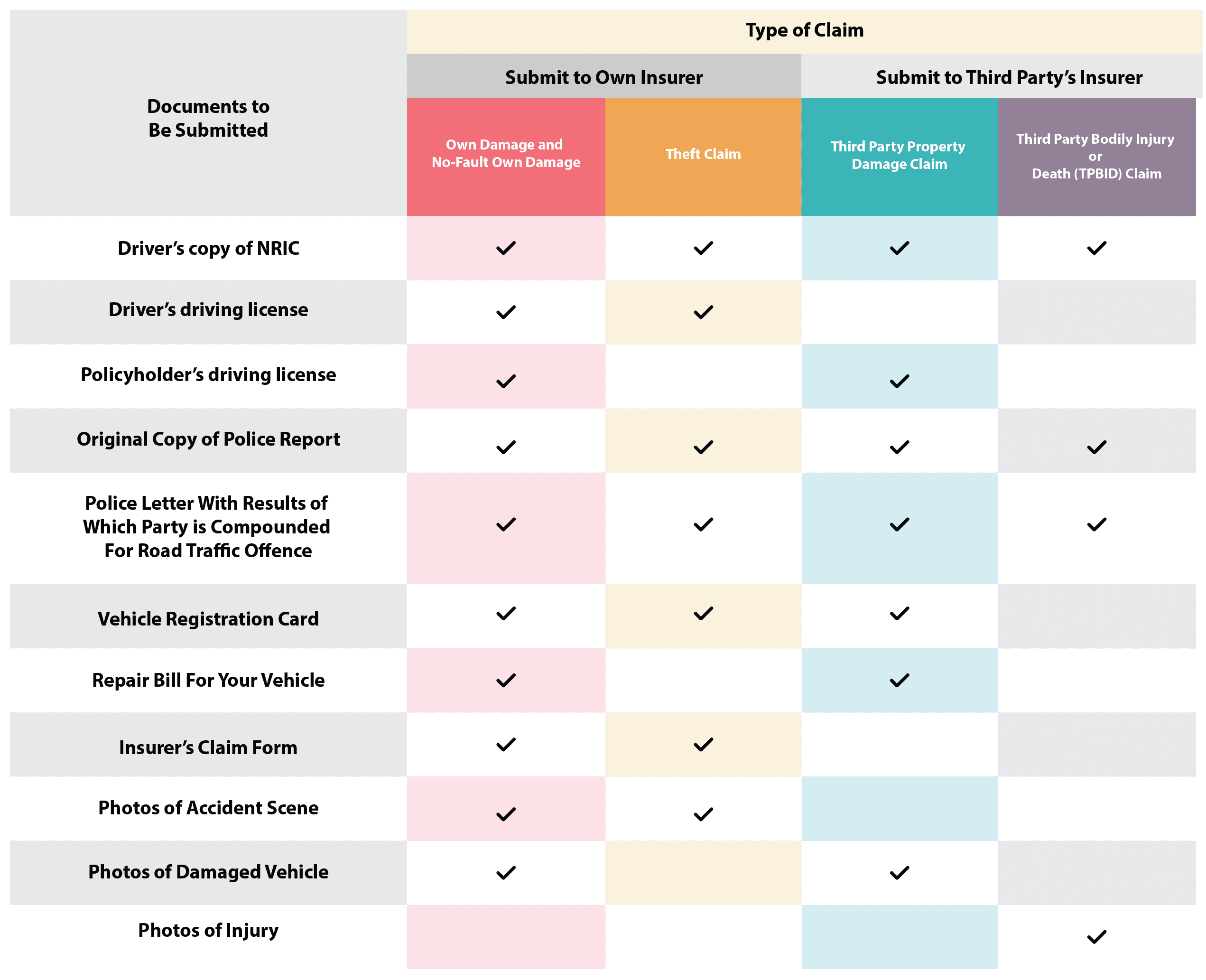

You can compare and apply for third party car insurance online. How to claim car insurance in Malaysia. When considering filing a claim either from your insurance or the third partys policy youll need to jot down a few essential details.

While there may be some overlaps in coverage eg. If you buy a new car the car seller will arrange insurance with the company that they have a relationship with. Having this insurance coverage allows car owners to be protected from having to pay the damages of another car in the event of an accident.

This discount then grows as the number of consecutive claim-free years you have increases and only reaches a limit when you have five or more. Car insurance is a compulsory cover that all vehicle owners must purchase. Theft of personal belongings in the car medical expenses and personal accident travel insurance and car insurance are actually very different.

Third-party fire and theft coverage. Third party fire and theft. There are three types of motor insurance available and the law requires that every driver has a minimum coverage of third party liability.

Well be honest this can get pretty tedious so be prepared. You cannot use motorised vehicles without it.

Best Car Insurance In Malaysia 2022 Compare And Buy Online

No Claim Discount Ncd The Complete Guide For Malaysia Car Owners

Best Car Insurance In Malaysia 2022 Compare And Buy Online

Everything About Car Insurance In Malaysia From Special Perils Coverage To Premiums

How To Choose The Right Type Of Motor Insurance For Your Needs

Comments

Post a Comment